Salaried employees pay is calculated on an annual basis and is divided between specified pay periods, which are normally weekly or bi-weekly. The amount and regularity of pay is stated in a salaried employee's contract. Some salaried employees are exempt employees under the FLSA rules. Most employers do not provide overtime pay for salaried employees. However, they may offer different benefits, like time off, as an alternative to overtime pay. If a salaried employee is considered to be a non-exempt worker, their employer must compensate them at time and one-half for hours worked over 40 hours in a week.

I paid my employee for 43 hours of wages during the last workweek. Eight of those hours were paid as sick leave, as the employee was out ill for one day. Am I required to pay the employee for three hours of overtime?

The required overtime pay is 1.5 times the hourly rate for hours worked in excess of 40 in a workweek. Overtime is calculated based on hours actually worked, and your employee worked only 35 hours during the workweek. Unless a policy, contract or collective bargaining agreement states otherwise, you needn´t count sick leave, vacation time, holidays, or other paid time during which the employee did not actually work.

My employer paid me for 43 hours of wages during the last workweek. Eight of those hours were paid as sick leave, as I was out ill for one day. Overtime is calculated based on hours actually worked, and in this scenario you worked only 35 hours during the workweek. Unless a policy, contract or collective bargaining agreement states otherwise, you do not get overtime pay if you used sick leave, vacation time, holidays, or other paid time and did not actually work. An employer covered by Fair Labor Standards Act ("FLSA") and the New York Labor Law ("NYLL") must pay their eligible employees overtime pay. One of the factors that determine overtime eligibility is how the employee is paid.

Employers may pay an employee an hourly rate, an annual salary, or some other agreed upon method (e.g., piecemeal, day rate). Regardless of the method of pay, the majority of employees are eligible for overtime pay in the amount of one and one-half times their regular hourly rate for all the hours worked over 40 in a workweek. According to the FLSA, employers must pay non-exempt employees no less than time and one half their regular pay rate for each hour over 40 in a workweek.

If a non-exempt employee isn't paid by the hour, the hourly rate can be calculatedby dividing the total compensation earned by the total hours worked. Vacation, holidays or sick days should not be included when performing these calculations unless the employee worked on those days. To properly compute overtime on a flat sum bonus, the bonus must be divided by the maximum legal regular hours worked in the bonus-earning period, not by the total hours worked in the bonus-earning period. This calculation will produce the regular rate of pay on the flat sum bonus earnings. Overtime on a flat sum bonus must then be paid at 1.5 times or 2 times this regular rate calculation for any overtime hour worked in the bonus-earning period. Overtime on production bonuses, bonuses designed as an incentive for increased production for each hour worked are computed differently from flat sum bonuses.

To compute overtime on a production bonus, the production bonus is divided by the total hours worked in the bonus earning period. This calculation will produce the regular rate of pay on the production bonus. Overtime on the production bonus is then paid at .5 times or 1 times the regular rate for all overtime hours worked in the bonus-earning period. Overtime on either type of bonus may be due on either a daily or weekly basis and must be paid in the pay period following the end of the bonus-earning period. The Fair Labor Standards Act, passed in 1938, guarantees employees compensation at one and a half times their regular rate for hours worked above 40 hours per week. How overtime is calculated depends on whether the employee is paid hourly or by salary.

Further, the calculation for salaried employees differs depending on the number of hours per week the salary is meant to compensate for. Finally, the Department of Labor recently issued a provision increasing the salary requirement necessary to be eligible to receive overtime pay when working over 40 hours per week. This could affect over a million workers by becoming entitled to receive overtime pay when working over 40 hours in a work week regardless of being a salaried employee. This area of law is very detail oriented and is evaluated on a case-by-case basis; therefore, if you are not being compensated for overtime you should consult an experienced employment attorney. Additionally, employees who are paid on a salary basis are still likely to be eligible to receive overtime pay.

In order to avoid paying salaried employees overtime, the employer has the burden of proving that an exemption applies. However, many employers misclassify their employees as exempt from the overtime provisions of the FLSA and the NYLL in order to save money on labor costs. Being paid on a "salary basis" means an employee regularly receives a predetermined amount of compensation each pay period on a weekly, or less frequent, basis.

The predetermined amount cannot be reduced because of variations in the quality or quantity of the employee's work. Subject to exceptions listed below, an exempt employee must receive the full salary for any week in which the employee performs any work, regardless of the number of days or hours worked. Exempt employees do not need to be paid for any workweek in which they perform no work.

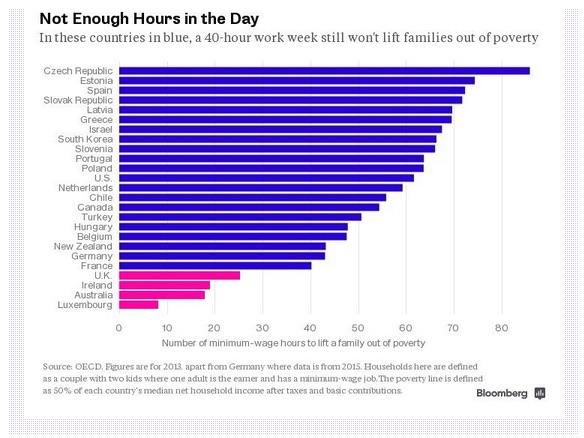

In the U.S., according to the payment rules regulated by the Fair Labour Standards, salary workers are not covered by overtime . It is worth mentioning, that in many countries companies offer their workers various kind of compensations for overtime hours. That might be just additional money, time off adequate to the number of overtime hours, or other benefits. When a salaried employee is classified as non-exempt under Fair Labour Standards, an employer has to pay one and a half for each extra hour over standard 40 per week. To avoid misunderstandings, clear all your doubts in your state's Department of Labour or your country's labour law.

A non-exempt employee is not exempt from FLSA regulations, rules and requirements. Non-exempt employees need to receive the state or federal minimum wage and overtime pay at not less than one-and-a-half times their hourly pay in the event that they work more than 40 hours a week. Is there a maximum number of hours employees can work during a day? For most adult workers, there are no limits on daily work hours. Theoretically, employers may schedule employees to work seven days a week, 24 hours per day, so long as minimum wage and overtime laws are observed.

Manufacturing employees are limited to 13 hours of work in a 24-hour period. There are also daily and weekly limitations on the hours minors can work. For more information, see the Oregon Wage & Hour Laws handbook. The calculation for overtime pay is your "regular rate of pay" x 1.5 x overtime hours worked.

In these instances, your regular rate should take into account these additional types of compensation. The number one positive aspect of hourly work is that employees are assured of a definite amount of money for every hour they work. Another perk of hourly work is that employees get overtime pay if they work over 40 hours per week. Some employers offer more than the mandatory time-and-a-half pay rate for overtime.

Therefore, an hourly employee can make double their hourly rate in some instances, for example, working during the holidays. Hourly workers are paid a specified hourly rate that is multiplied by the number of hours worked over a particular pay period. Under the Fair Labor Standards Act , all hourly workers are regarded as non-exempt employees. This means that hourly workers must be compensated at a rate of time and one-half for every hour worked over 40 hours in a week.

Most hourly workers are promised a specified amount of hours per week. The exception is where the hourly worker is subject to a labor contract. Overtime wages must be paid no later than the payday for the next regular payroll period after which the overtime wages were earned.

Earnings may be determined on a piece-rate, salary, commission, or some other basis, but in all such cases the overtime pay due must be computed on the basis of the average hourly rate derived from such earnings. This is calculated by dividing the total pay for employment in any workweek by the total number of hours actually worked. Unless specifically exempted, employees covered by the Act must receive overtime pay for hours worked in excess of 40 in a workweek at a rate not less than time and one-half their regular rates of pay.

There is no limit in the Act on the number of hours employees aged 16 and older may work in any workweek. The Act does not require overtime pay for work on Saturdays, Sundays, holidays, or regular days of rest, as such. Salary to hourly wage calculator lets you see how much you earn over different periods. It is a flexible tool that allows you to convert your annual remuneration to an hourly paycheck, recalculate monthly wage to hourly rate, weekly rate to a yearly wage, etc.

This salary converter does it all very quickly and easily, saving you time and effort. In the article below, you can find information about salary ranges, a closer look at hourly and annual types of employment, as well as the pros and cons for each of these. Moreover, you can find a step-by-step explanation of how to use this paycheck calculator down below.

A base salary is the minimum amount you can expect to earn in exchange for your time or services. This is the amount earned before benefits, bonuses, or compensation is added. Base salaries are set at either an hourly rate or as weekly, monthly, or annual income. The key difference between salaried and hourly employees is how they get compensated for their work. Employees who work on an hourly basis get paid for every hour that they perform their job and have the right to receive overtime pay if more than 40 hours is worked.

On the other hand, salaried employees are not generally eligible for overtime pay. Increasingly, the young turks are actually young Indians or young Chinese—or whatever smart and hardworking population offers a labor cost advantage. The threat of losing jobs to outsourcing arrangements is another driver in the rise of extreme work. The number of work hours in a year can be useful when figuring out an employee's yearly pay for a salary or to calculate salary into an hourly rate if schedules are changing. To figure out an employee's yearly pay for a salary, just multiply the suggested hourly rate by the number of work hours in a year. Your business may choose to pay for vacation days or even holidays and if that is the case, you will need to use the number of hours in a year before subtracting vacation days or holidays.

For example, if Juan earns $23 an hour, works 40 hours a week, gets 10 holidays off a year and 14 vacation days per year, he should earn $47,850 if he receives paid holidays and vacations. If he gets paid vacation days, but holidays are unpaid, he should earn $46,010 ($47,850 less his hourly rate multiplied by the 8 hours from each of the 10 holiday days). If all of his vacation days and holidays are unpaid, he should receive $43,434 ($47,850 less his hourly rate multiplied by the 8 hours from each of the 24 holiday and vacation days). Yes, there are certain types of payments that are excluded from the regular rate of pay. The agreed upon regular hours must be used if they areless thanthe legal maximum regular hours. For example, if you work 32 to 38 hours each week, there is an agreed average workweek of 35 hours, and thirty-five hours is the figure used to determine the regular rate of pay.

Salary 40 Hours If you work more than 35 but fewer than 40 hours in a workweek, you will be entitled to be paid for the extra hours at your regular rate of pay unless you work over eight hours in a workday or 40 hours in a workweek. The regular rate of pay cannot be less than the minimum wage . The regular rate includes all remuneration for employment except certain payments excluded by the Act itself. An employee's workweek is a fixed and regularly recurring period of 168 hours -- seven consecutive 24-hour periods. It need not coincide with the calendar week, but may begin on any day and at any hour of the day. Different workweeks may be established for different employees or groups of employees.

Normally, overtime pay earned in a particular workweek must be paid on the regular pay day for the pay period in which the wages were earned. An exempt employee is someone who is excluded from overtime regulations, minimum wage, and other protections and rights that are available to non-exempt workers. In order for an employee to be classified as exempt, employers need to pay them a salary instead of an hourly wage. And although the FLSA has evolved since its passage in 1938, one thing remains the same – employers must classify their employees correctly or risk costly compliance violations.

It is up to the employer to choose whether to pay biweekly or semi-monthly, but however a paycheck is issued, employers will need to know the employee's per-hour rate to determine their pay in a given period. A weekly paycheck for an employee that works 40 hours a week should be for 40 hours, for bi-weekly payments, the amount should cover 80 hours and for semi-monthly payments, the pay period should be 86.67 hours long . Any unpaid holidays or vacation days should be deducted from the hours used in the pay period calculation. The other option is to pay a non-exempt employee a Fixed Salary for a Fluctuating Workweek .

The FSFW method is a useful option when an employee's hours change from week-to-week. Even if you're are a salaried employee, you may be entitled to overtime pay. As a simple baseline calculation, let's say you take 2 weeks off each year as unpaid vacation time. Then you would be working 50 weeks of the year, and if you work a typical 40 hours a week, you have a total of 2,000 hours of work each year.

In this case, you can quickly compute the hourly wage by dividing the annual salary by 2000. Your yearly salary of $72,000 is then equivalent to an average hourly wage of$36 per hour. So let's look how these 41.8 hours per week translate into an average hourly wage in the UK. We'll assume 5 weeks of holidays and 8 bank holidays, which means that a total of 6.7 weeks a year are off. This leaves us with 45.4 working weeks, which in turn leaves us with an average of 693£ per week.

Can my employer offer me "comp" time off instead of paying overtime? Only government agencies are permitted to offer compensatory time in lieu of overtime. If you are a private sector employee, you must received overtime pay when you work over 40 hours in a workweek.

Your employer can discipline you for violating its policy by working overtime without the required authorization. However, wage and hour laws require that you are compensated for hours you work. Because this method results in employees getting less overtime pay than under any other overtime calculation, workers' rights advocates did not want to encourage more employers to use the fluctuating workweek method.

The FLSA governs federal minimum wage, overtime, recordkeeping and youth employment for individuals working in both the private and public sectors. Some state and local jurisdictions, however, have their own wage and hour laws. In these cases, the DOL says that employers must apply the minimum wage or overtime rate that is most favorable to the employee. To translate a person's salary into an hourly rate, simply divide the yearly salary by the number of work hours in a year. Again, remember to include any vacation or holiday hours that the employee is paid.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.